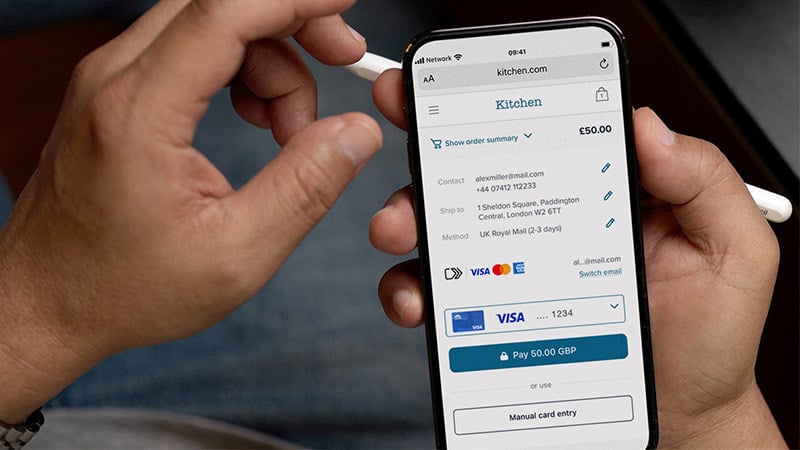

A consistent integrated checkout experience

Visa Click to Pay brings the convenience of contactless to your online store

Online shopping. Simplified.

Clear benefits for your business

A seamless payment journey, enabling merchants to focus on customer acquisition during the checkout flow

Optimises sales conversions, with higher authorisation rates and lower fraud risk

Performs 3DS payment authentication

Use Visa Tokens to optimise security and performance

1. VisaNet Data, GBI Monthly Authorisation Report, May 2022

2. Fraud Rate Reduction: Source: CNP Average is for set of Token participating Merchants (by Merchant DBA) (PAN & Token) with digital wallet TRs Feb-Apr 2022 Issuer region: Europe; Visa Token transactions compared to PAN-based transactions online

Exact uplift in authorisation approval rates and reduction in fraud may vary between different merchants and use cases

EMV® is a registered trademark in the U.S. and other countries and an unregistered trademark elsewhere. The EMV trademark is owned by EMVCo, LLC

How it works

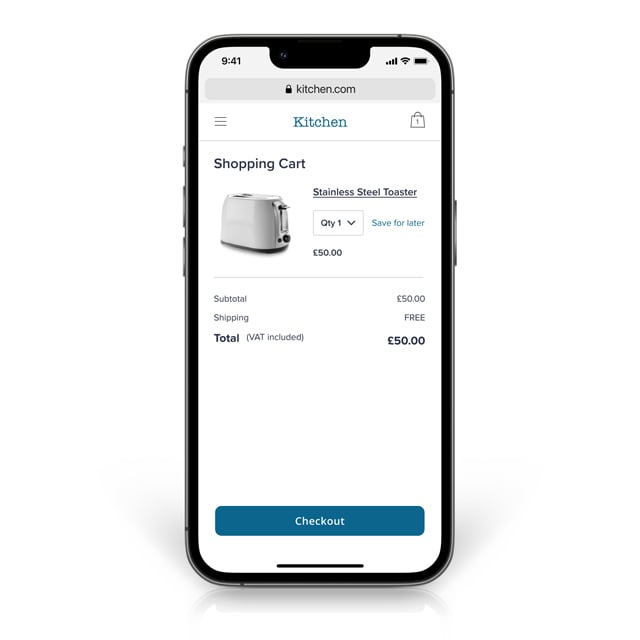

Step 1

Customer adds goods to their cart and proceeds to checkout

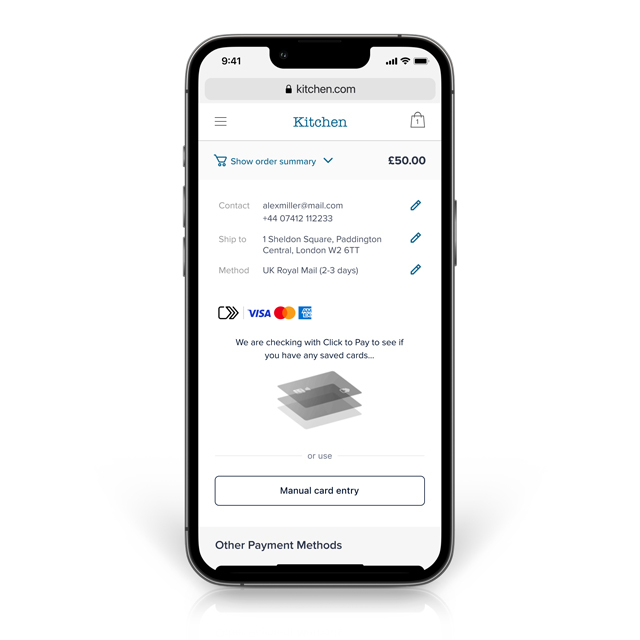

Step 2

Customer enters their personal information and Click to Pay checks for their stored cards

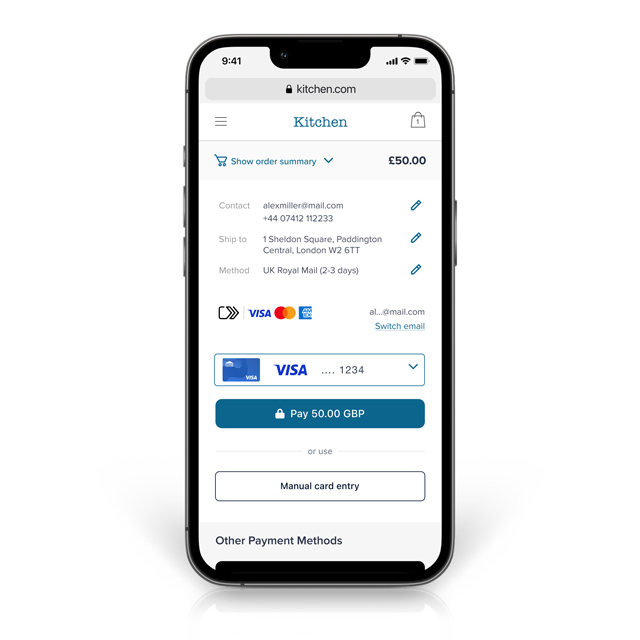

Step 3

Click to Pay retrieves all stored cards. Customer selects card of choice and completes payment

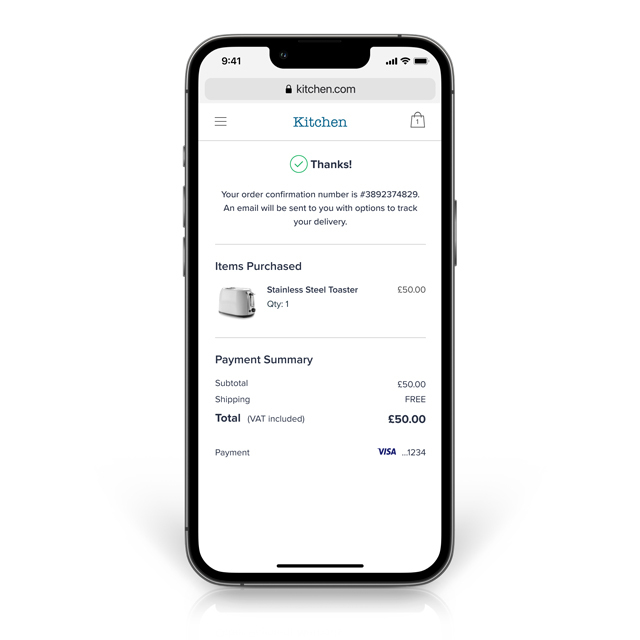

Step 4

Customer is provided with confirmation of their purchase

Other ways Visa helps keep your data secure

EMV® Secure Remote Commerce (SRC)

EMV® SRC is the technology underpinning Click to Pay. It aims to simplify the e-commerce checkout experience, making it consistent, convenient and secure.

Strong Customer Authentication (SCA)

SCA is a new requirement of PSD2, which adds extra layers of security to electronic payments. Learn what the new regulation might mean for you.

Tokenization

Tokenization replaces sensitive data (eg. card numbers) in electronic transactions with a secure equivalent: a token. Find out how Visa’s token technology can help protect your data and reputation.