When racing cars roar through Monaco (MCO), Barcelona (ESP), or Spielberg (AUT), the spotlight isn’t only on the podium. Across Europe, the racing season sparks a dynamic economic ripple – moving from city to city with pit stop precision.

While motor racing has long been celebrated for its speed, spectacle, and passion, Visa’s analysis over the past three years uncovers a more interesting story. Each race weekend brings a surge in local demand – from premium stays to everyday experiences – showing how sport can shift spending patterns and accelerate spend in unexpected ways.

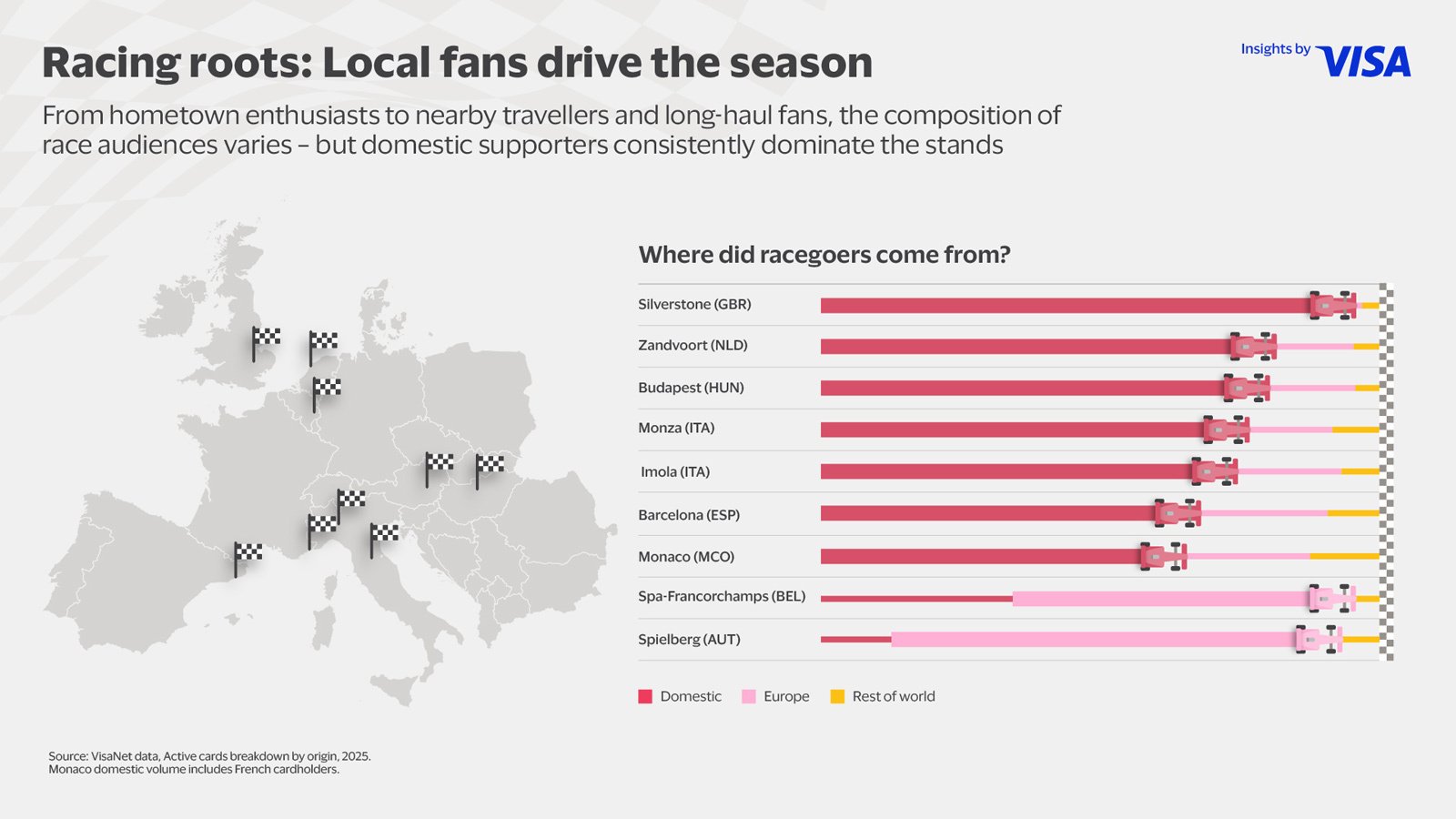

While local fans still dominate the grandstands, Visa’s analysis of international fan attendance reveals a compelling shift in audience origins – driven by the rising global interest in the sport and even subtle calendar changes. This isn’t just about numbers; it’s about new markets discovering the thrill of European racing.

Visa data shows that Americans remain a major force, making up 51% of additional visitors to Silverstone (GBR) in 2025 and 35% of new international arrivals in Monaco¹. Fans from the Czech Republic, Germany, and Slovakia are increasingly travelling to attend races in neighbouring countries. Even out-of-town tracks like Spielberg and Spa-Francorchamps (BEL) are drawing international crowds - proof that racing passion knows no boundaries.

Fans in the UK, Switzerland and France show consistent loyalty, regularly ranking in the top ten visiting nationalities. But the leaderboard is evolving. China and Taiwan are now making their mark at Monza (ITA), underscoring the sport’s expanding global reach.

Cancellation of races can trigger a reshuffling of fan travel patterns, with spectators redirecting their enthusiasm to other races.

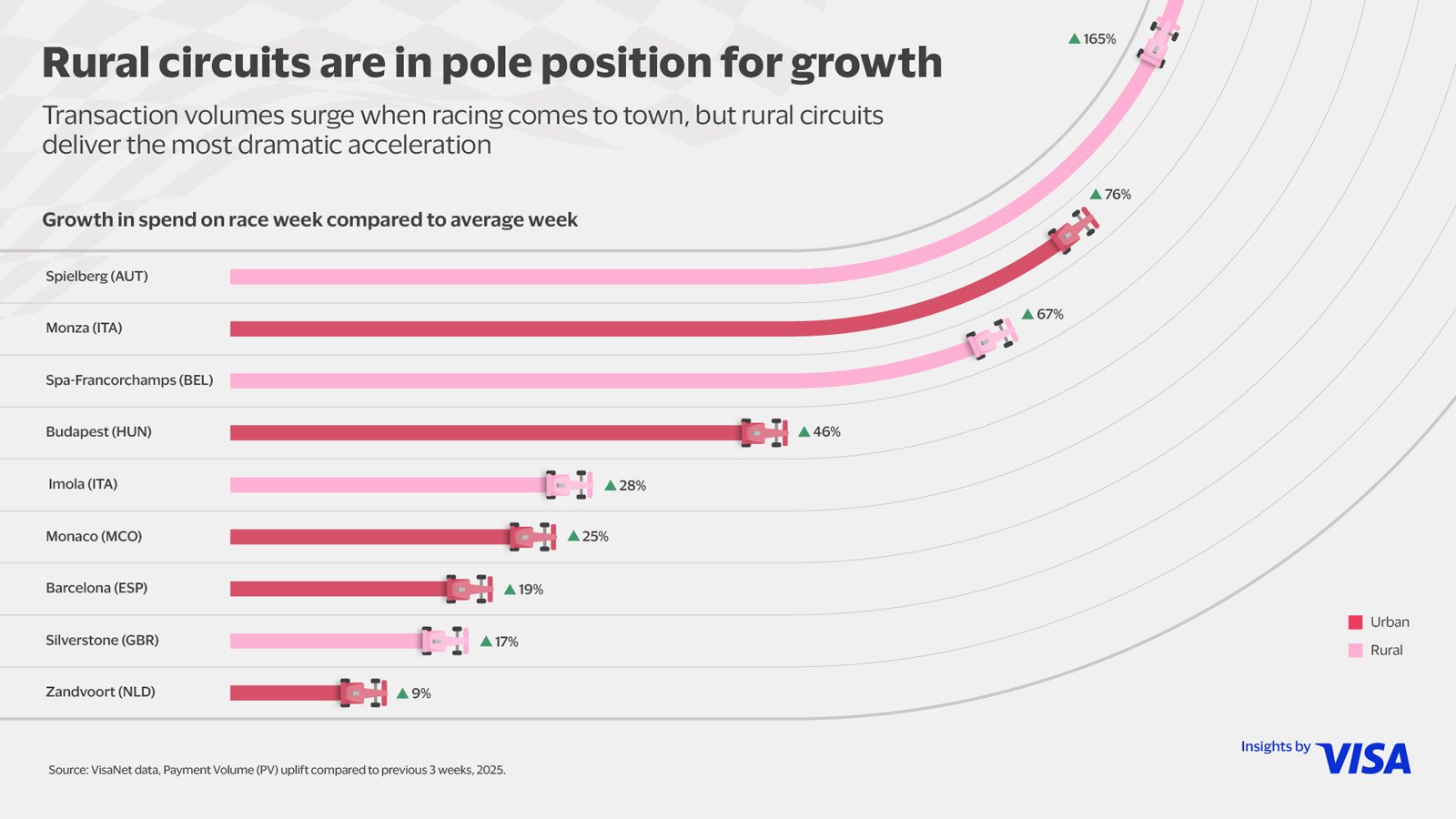

The connection between audience mix and economic impact reveals a powerful trend: the more international the audience, the more dramatic the economic acceleration becomes. Urban circuits like Monza and Budapest (HUN) enjoy balanced growth from both domestic and international crowds, but rural venues? They absolutely take off.

According to Visa data, Spielberg delivered the season’s most spectacular uplift in transactions,, with international spending surging by around 700% with domestic spending up by 170% versus non-race weeks². International spending more than doubled at Spa-Francorchamps and Imola, underscoring the growing cross-border appeal of these destinations and their capacity to drive significant incremental economic activity. Silverstone’s total uplift remained below average due to its high proportion of domestic fans.

Urban centres tell more complex stories. Monaco still enjoys impressive spending growth during race week, but its gains spread across multiple sectors and become diluted by year-round luxury tourism flows. The concentration effect that rural venues experience simply doesn’t occur in established tourist destinations, where racing fans blend into existing visitor patterns.

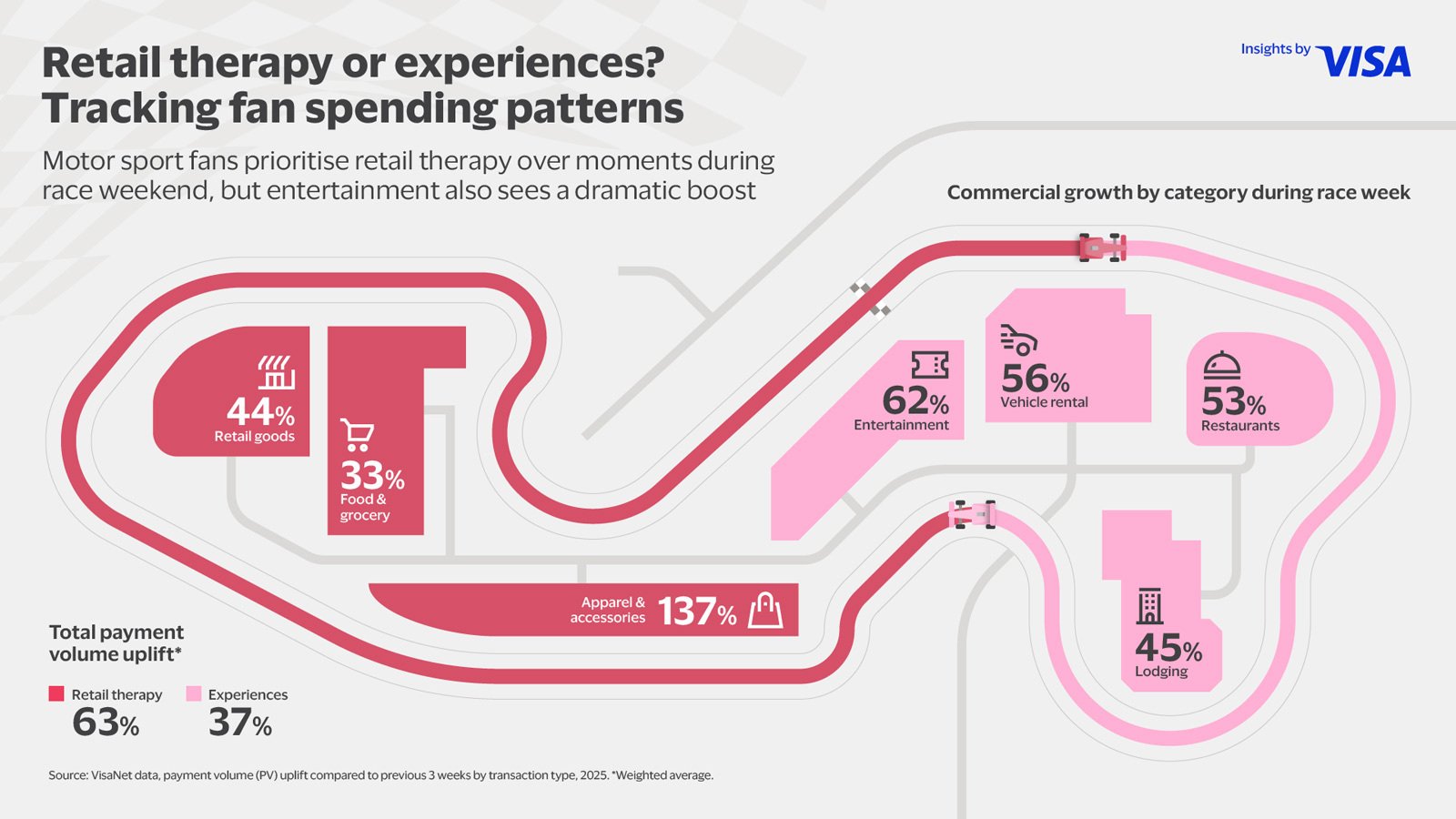

While modern racing fans are increasingly seeking out experiences, they still prioritise retail therapy – but location shapes their spending behaviour. Visa data highlights that events located near major transport networks and urban centres – and the proportion of international fans – are key factors influencing spending on travel necessities like accommodation, food and fuel.

International fans consistently help boost local restaurant scenes, leading to strong spending increases particularly when venues are close to urban areas – likely reflecting greater availability and variety of dining options. Rural tracks see different patterns entirely, with retail goods and automotive spending often surging as fans stock up on merchandise and travel essentials.

Monaco and Budapest demonstrate yet another spending profile, showing lower entertainment expenditure but significantly higher air travel and hotel bills. This pattern signals these destinations serve as part of longer trips rather than standalone racing pilgrimages, with visitors extending their stays to explore broader regional offerings.

The big takeaway

Motor racing is more than just a sport – it’s a predictable, movable market that operates with the precision of a well-tuned engine. The European racing season acts as a rolling marketplace that sweeps across the continent from spring to autumn. Its predictable calendar brings shifting audiences influenced by timing and geopolitics, while spending patterns vary between urban and rural locations.

For businesses, the opportunity couldn’t be clearer: treat race weekends like high value travelling marketplaces. Understanding when crowds arrive, where they originate, and their spending preferences allows strategic positioning before the starting grid is set. With the right strategy, a single race weekend can spark economic benefits that last all year. Those who respond with agility and align their offerings to meet fans where demand is emerging will be best placed to capture long-term commercial advantage.

About Visa Consulting & Analytics (VCA)

This analysis of how motor sport fuels commerce and tourism across European economies demonstrates just one example of how Visa leverages exclusive access to VisaNet data and insights. VCA combines payments consulting expertise with proprietary analytics to provide businesses with actionable insights into consumer payment behaviour and spending patterns across channels and markets.

Ready to capitalise on motor sport’s economic potential? Discover how VCA can help accelerate your business strategy – email [email protected] or visit us at visa.com/vca

Sources

1. Identified by unique Visa cardholders not from Monaco / GBR doing in-person transactions in Monaco / Silverstone (GBR) on race week vs average of the previous 3 weeks

2. Identified by spend from Visa cardholders not from Austria doing in-person transactions in Spielberg on race week vs average of the previous 3 weeks

Disclaimer:

All insights and data provided are based on VisaNet data for transactions within a 15km-radius from the race location for race week (Monday to Sunday, incl. race weekend) vs the previous 3-week average (2-week for Hungary) for the 2025 season.

Case studies, statistics, research and recommendations are provided “AS IS” and intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice. Visa Inc. does not make any warranty or representation as to the completeness or accuracy of the Information within this document, nor assume any liability or responsibility that may result from reliance on such Information. The Information contained herein is not intended as legal advice, and readers are encouraged to seek the advice of a competent legal professional where such advice is required.