-

A simpler instalments solution for merchants

Visa's instalments solution enables merchants to offer a frictionless instalment payment option to their customers.

Visa Instalments Solution (VIS) APIs

A card-based instalments solution sitting on top of Visa's payment technology to add even more value to both merchants and their customers.

Instalments trends and opportunities

Changing consumer behaviour and digitalisation have increased demand for instalment payments. Merchants will need to adapt to address customer needs.

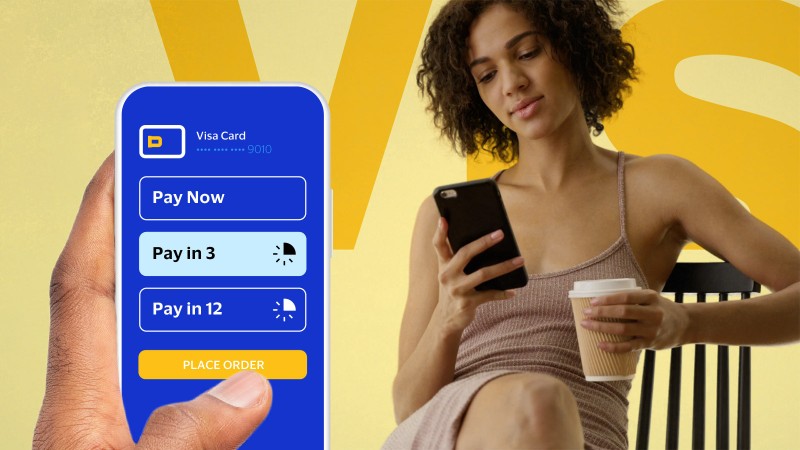

How VIS works

Offering instalment payments at the checkout, when it is most relevant to the customer, is simple with VIS. Here is how it works:

Merchant Benefits

There are many benefits for merchants and businesses who accept instalments. Whether it's in-store or online, you can now offer your customers frictionless, personalised instalments plans backed by established issuers and provided by Visa - a brand they already know and trust.

Visa Instalments Solution Partners

Frictionless instalment payment options through VIS are supported by:

Other ways to accept Visa payments

Visa Instalments Solution is just the start. Discover the other ways your business can start accepting Visa.

Visa Instalment Credential (VIC)

VIC is a virtual card-based solution that automatically splits eligible transactions into instalments, and can be used anywhere Visa is accepted.

Click to Pay

Visa Click to Pay makes shopping online consistent, easy and secure for your customers.

Contactless Payments

Frequently Asked Questions

-

-

There are two ways you can start offering instalments. You can connect via your acquirer or your payment enabler (e.g. your e-commerce or payment orchestration platforms). To find out more about your options, speak to your acquirer or payment enabler today.

-

-

There are a number of benefits for merchants and businesses who accept VIS, from increasing sales and repeat purchases to improving wider consumer spending habits and behaviour.

-

-

Any business who uses an acquirer or payment enabler that supports Instalments enabled by Visa can start accepting and benefitting from payment in instalments. Large enterprise merchants can also reach out directly to your Visa representative to discuss accepting instalments.

-

-

We're currently working with all the UK’s largest acquirers on rolling out instalments, so check with your acquirer to see whether they're already live. A growing number of e-commerce, payment orchestration platforms and other payment enablers are also offering Instalments enabled by Visa. To find out more, reach out to your acquirer to discuss VIS today.

-

-

Instalments credit is provided by card issuers - banks regulated in the UK that have to meet strict lending standards. We as Visa also have guidelines in place to ensure that instalment offers are presented with customer needs in mind.

-

-

As the lenders, the card issuers determine the cost of providing instalments. Card issuers will set interest rates for consumers and fees for merchants. However, as the merchant you will always have the final say over which offers you want to display, whether you want to pay for any of them or whether you only want to show consumer-funded instalment plans.

-

-

Instalments enabled by Visa works both in-store and online. To find out whether it is already enabled, simply speak to your terminal provider.

-

-

Yes. As we continue to roll out Visa Instalments Solution globally, there will be a growing number of consumers able to access instalments as they shop abroad.

-

-

No, your current card acceptance, return, refund and other payment processes will continue as they are today. You'll also continue to be paid in full on the same timelines as you are today. Instalments are a value-added service that sits separate to and on top of the existing card transaction flow.

-

-

Whilst card issuers decide which instalment plans they want to fund for their cardholders and make available on their cards, as the merchant you are the one who ultimately decides which plans you want to show to your customers at check-out. You can do this by selecting from the plans that an issuer has agreed to provide.

-

-

There are a number of ways through which your customer can find out about Instalments enabled by Visa: their card issuers will inform them that instalments are available and where; Visa will run marketing campaigns to raise awareness around instalments and you can choose where to advertise instalments within your customer communications and customer journey design.

-

-

Visa Instalments Solution is the underlying API technology that powers Instalments enabled by Visa, which is the name of the end-product available to consumers.

¹Europe Buy Now Pay Later Market Report 2023: BNPL Payments are Expected to Grow by 20.5% to Reach $184,658.3 Million in 2023 - Forecasts to 2028, Research and Markets , 2023

²RFI Global

³https://www.globalpayments.com/insights/2022/02/21/why-buy-now-pay-later-is-a-2022-trend-to-watch

⁴RFi H2 2022 Research

⁵Buy Now Pay Later Improves Sales for Two Thirds of UK Retailers, 2022; https://thewisemarketer.com

⁶*Availability of specific instalment program products and features may vary by market and is subject to change. Issuer is solely responsible for its own instalment program.