Executive summary

The opportunity in B2B cross-border payments is even greater, but so are the stakes. Banks currently hold a strong position, supported by trust, regulatory credibility and client relationships. Yet, these advantages are under pressure as businesses increasingly demand more: real-time settlement, price transparency, digital integration and flexibility.

Fintechs are already making inroads with SMBs and have their eyes on large corporates. To maintain leadership, banks must act decisively – not with one-size-fits-all approaches, but with tailored solutions that meet evolving client needs.

This isn’t a passing trend. More than half of remittance users globally expect to send more or the same amount of money overseas in 2025.⁴ Fintechs have already secured a strong foothold in this space. For banks, this represents a critical moment: the opportunity is significant. They also face the risk of losing cross-border revenue and wider income streams, as fintechs expand into traditional banking services and capture a greater share of business.

People have become global citizens, driving growth in cross-border payments

High cross-border P2P flows put significant revenue streams within reach

Remittance fees generate substantial revenue, making them a significant and established source of income for financial institutions.

The cost of sending remittances varies by corridor, currency and transaction value, but the G20 has a target to reduce costs to 3% by 2030. Meeting this target could mean reduced revenue for banks.

In parallel, if banks continue to lose customers to fintechs, it won’t just mean reduced revenues from remittance fees. Associated revenue streams, such as foreign exchange (FX) margins and account fees could also be at risk.

Flows from five countries represent more than half of European remittances

Geopolitical crises affect remittances and therefore potential revenue

Source: Confidential consumer survey. Visa Consulting & Analytics, Jan. 2024 – May 2025. Unpublished data.

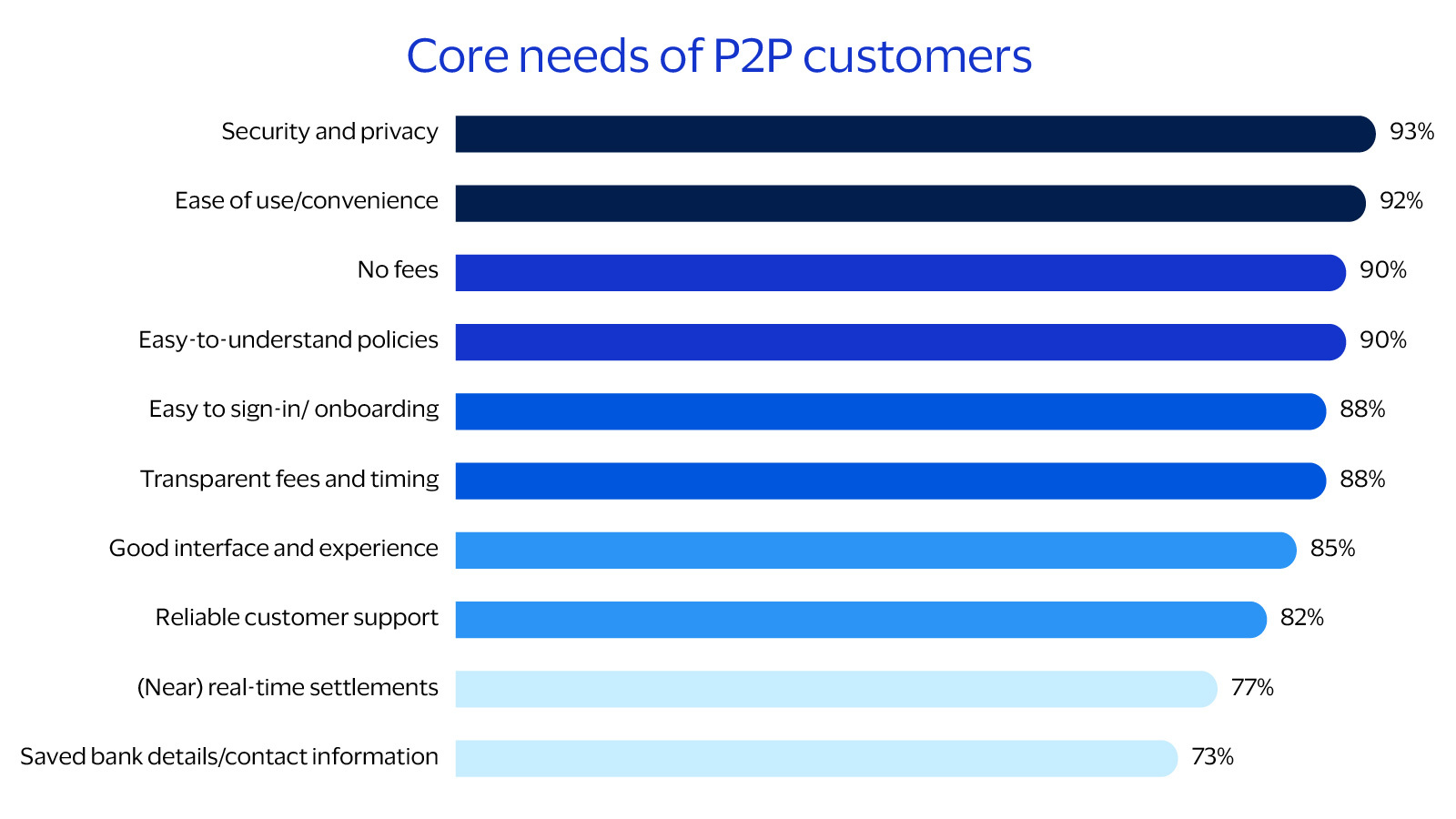

5 pain points driving customers away from traditional banks to fintechs

Banks are losing the remittances race as fintechs gain dominance in the market

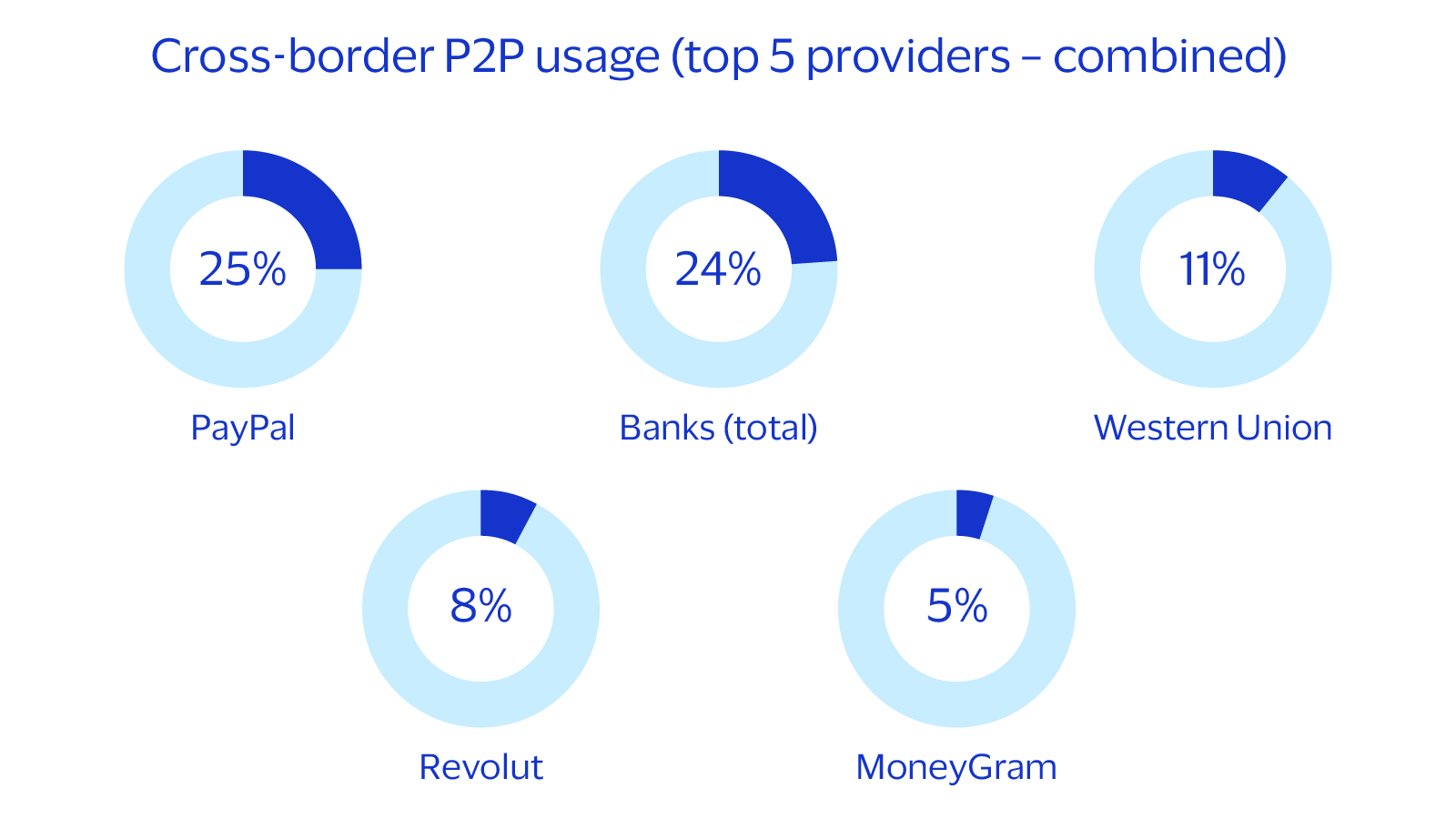

Fintechs are gaining ground. Banks will find it a challenge to catch up to fintechs’ pace or mitigate further market share loss.⁹

Customers’ loyalty to banks is no longer guaranteed

Many customers have historically stayed with banks out of trust, familiarity or lack of awareness over new alternatives, despite pain points like high fees and slow transfers. But that loyalty is eroding. Fintechs are now more visible and accessible, engaging customers through intuitive digital platforms and replacing the personal bank relationship with seamless digital experiences. Banks are at risk of losing customers, not just for cross-border payments but for other revenue streams of their core banking business, such as investments and loans.

Fintechs are redefining market expectations

Traditional banks that fail to innovate risk becoming irrelevant, losing their place not only in payments but also the rapidly evolving payments ecosystem.

Fintechs are now rivalling or surpassing banks in P2P cross-border usage

Source: Confidential consumer survey. Visa Consulting & Analytics, Jan. 2024 – May 2025. Unpublished data.

The fintech proposition goes beyond payments

Structural advantages still favour traditional banks

First choice due to established trust and security

Expectations are changing and pain points persist

Footnote: Central European markets include the Netherlands, Germany, Austria and Switzerland. CEE includes Romania, Poland and Czech Republic.

Banks are still dominant but challengers are gaining traction

Footnote: B2B cross-border volumes encompass payments to suppliers abroad (goods and services imports) and purchases with business and corporate cards in foreign countries.

Source: Confidential consumer survey. Visa Consulting & Analytics, Jan. 2024 – May 2025. Unpublished data.

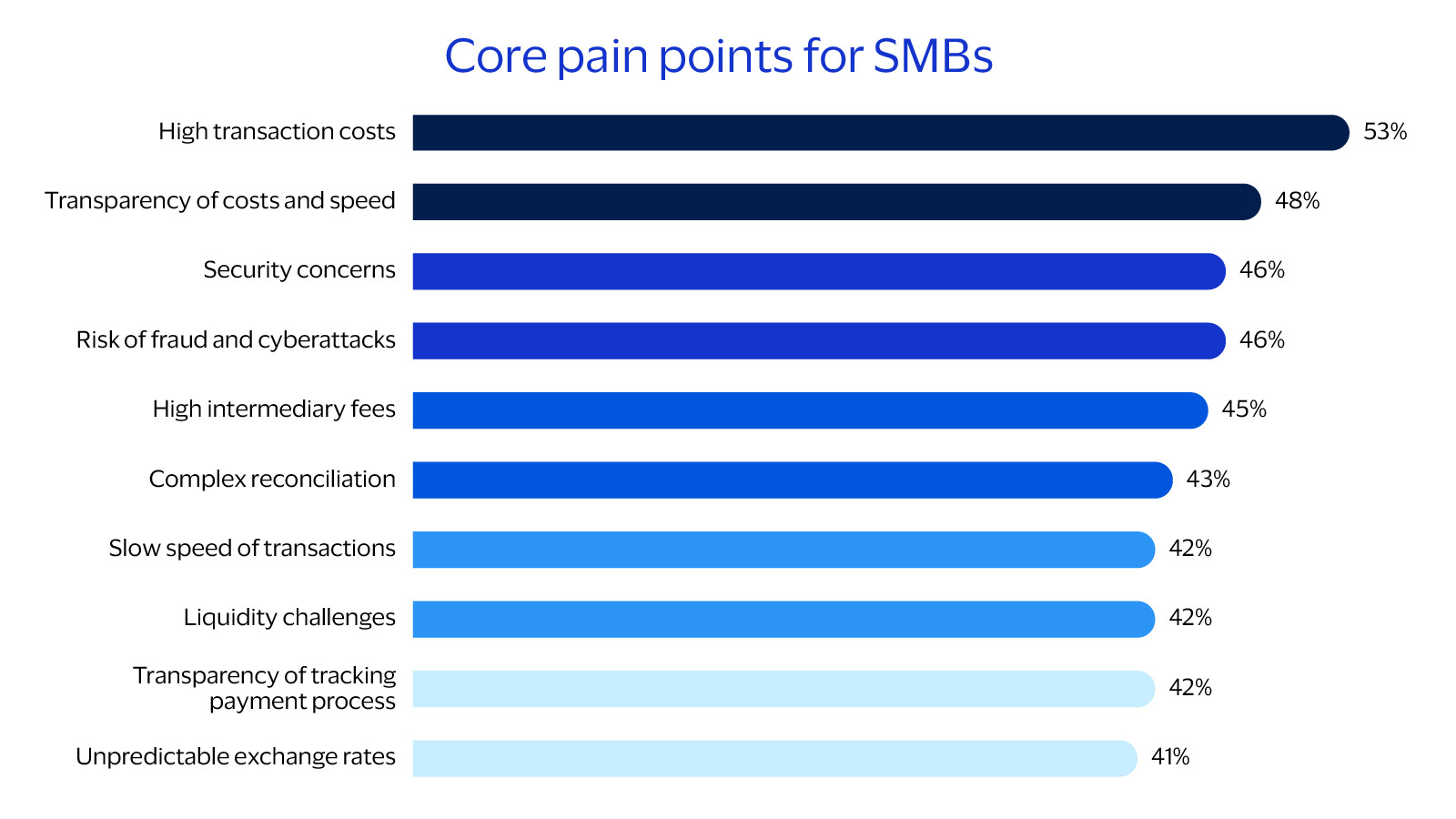

Three key challenges for European SMBs

SMBs expect affordable, transparent, user-friendly solutions

Lack of transparency in pricing and timing undermines trust

Security concerns shape provider selection

Source: Confidential consumer survey. Visa Consulting & Analytics, Jan. 2024 – May 2025. Unpublished data.

Payment volumes highlight priority markets

Footnote: Small and medium businesses (SMBs) encompass micro, small and medium-sized businesses with fewer than 250 employees.

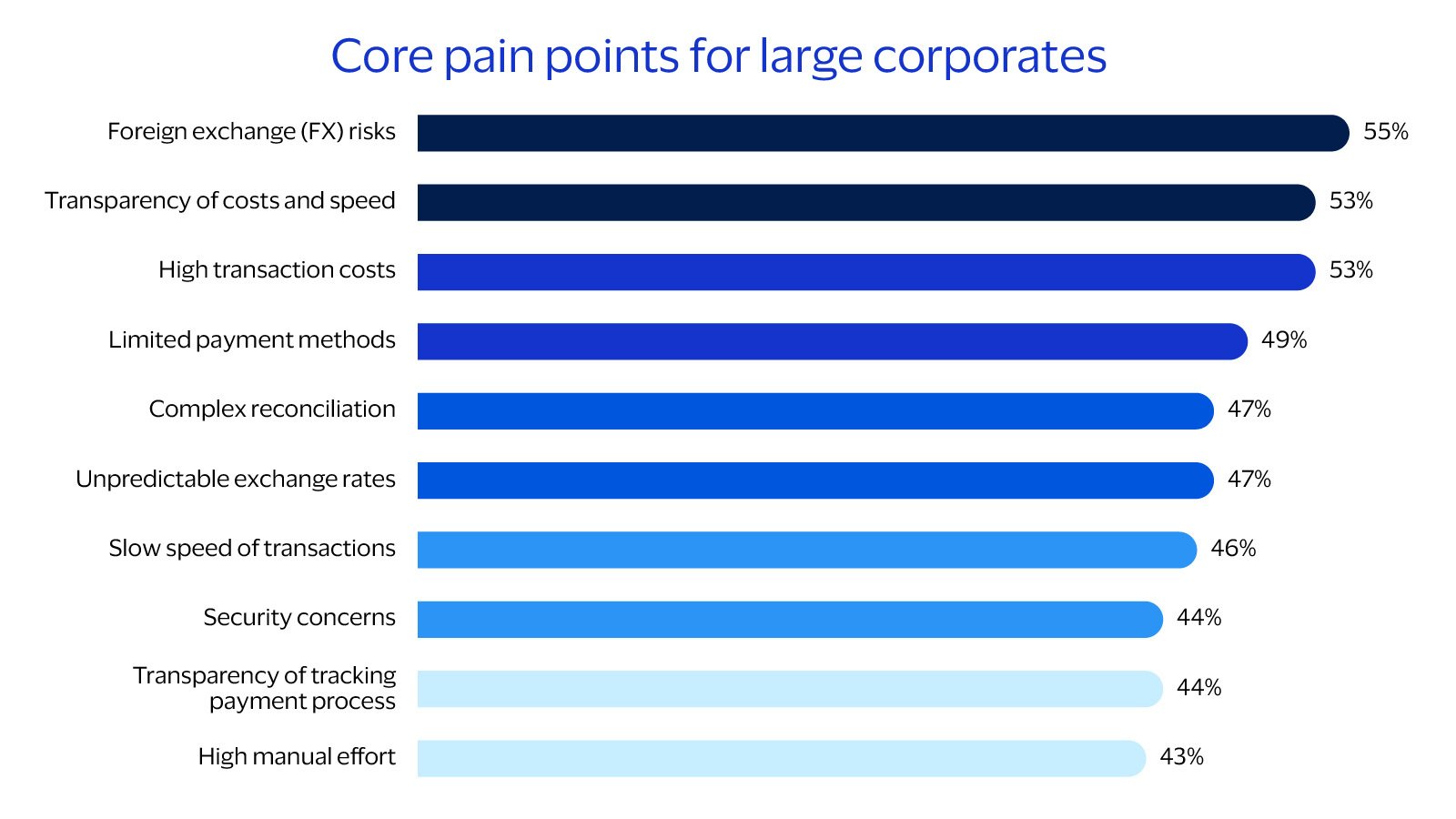

Distinct pain points demand tailored solutions

Banks must act to maintain leadership

Fintechs will soon move from SMBs to large corporates

While their current focus remains on SMBs, fintechs are steadily building the capabilities to serve larger, more complex businesses. Their agility and customer-centric approach are reshaping expectations across the market, increasing the urgency for banks to respond with improved, segment-specific solutions.

Source: Confidential consumer survey. Visa Consulting & Analytics, Jan. 2024 – May 2025. Unpublished data.

Modern platforms like Visa Direct enable banks to upgrade their cross-border payment services quickly and effectively. From real-time settlement to automation, transparency and security, Visa Direct supports scalable growth across both SMB and corporate segments.

Source: Confidential consumer survey. Visa Consulting & Analytics, Jan. 2024 – May 2025. Unpublished data.

Sources

1. Migration Data Portal. (2023). Remittances. Migration Data Portal. https://www.migrationdataportal.org/themes/remittances-overview

2. KNOMAD/World Bank Bilateral Remittance Matrix 2021. (December 2022). 2024 payment volumes are estimated using a 8.47% growth from 2021 to 2024. Growth rate has been retrieved from Dilip Ratha, Sonia Plaza, Eung Ju Kim, Vandana Chandra, Nyasha Kurasha, and Baran Pradhan. 2023. Migration and Development Brief 38: Remittances Remain Resilient But Are Slowing. KNOMAD–World Bank, Washington, DC.

3. World Bank. (2024, June 26). Remittances Slowed in 2023, Expected to Grow Faster in 2024. World Bank. https://www.worldbank.org/en/news/press-release/2024/06/26/remittances-slowed-in-2023-expected-to-grow-faster-in-2024

4. Visa. (2025). Money Travels: 2025 Digital Remittances Adoption Report. Visa.

5. United Nations Department of Economic and Social Affairs, Population Division. (2024). International Migrant Stock 2024. United Nations Department of Economic and Social Affairs.

6. Worldbank, “Remittances slowed in 2023, Expected to grow faster in 2024”, June 2024

7. Financial Stability Board. (2023, October 9). Annual Progress Report on Meeting the Targets for Cross-Border Payments: 2023 Report on Key Performance Indicators. Fsb.org. https://www.fsb.org/2023/10/annual-progress-report-on-meeting-the-targets-for-cross-border-payments-2023-report-on-key-performance-indicators/

8. World Bank Blogs. (2022). Russia-Ukraine Conflict: Implications for Remittance flows to Ukraine and Central Asia. (n.d.). World Bank Blogs. https://blogs.worldbank.org/en/peoplemove/russia-ukraine-conflict-implications-remittance-flows-ukraine-and-central-asia

9. Visa Data. (June 2025). List of remittance services providers accounted for in "P2P - Trx to top players" and "P2P - Country trx to remitters". Visa.

10. GlobalData. (September 2024). Key Trends in Cross-Border Payments, 2024. GlobalData UK Ltd. https://www.globaldata.com/store/report/cross-border-payments-market-analysis/

11. CMS 2023 Market Sizing is based on a combination of data from the 2022 McKinsey Global Payments Map and 2022 EY Visa Direct Global Market Sizing Study (latter based on 2021 data). Russia and China domestic markets are excluded from the global market size. McKinsey Global Payments Map includes 47 markets globally, which comprise ~90% of global GDP. EY Visa Direct Global Market Sizing Study includes 59 markets globally and also estimates the rest of AP, CEMEA, EU, and LAC regions for countries not analyzed specifically.

12. Confidential consumer survey. Visa Consulting & Analytics, Jan. 2024 – May 2025. Unpublished data.

13. Eurostat. (2025). “Trade by NACE Rev. 2 activity and enterprise size class”. Eurostat. https://ec.europa.eu/eurostat/databrowser/view/ext_tec01/default/table?lang=en

14. Visa Consulting & Analytics. (June 2025). Data from German SMB international trade data. Visa.

Disclaimers

The projections and growth estimates contained in this document are based on historical data, current market trends, and a variety of assumptions. These projections are intended for informational purposes only and should not be interpreted as guarantees of future performance. While we strive to provide accurate and realistic forecasts, numerous factors, including but not limited to market volatility, economic changes, and unforeseen circumstances, can influence actual outcomes. Consequently, there is no assurance that the clients will achieve the projected growth levels. We recommend that clients consider these projections as one of many tools in their decision-making process and consult with Visa Consulting and Analytics for personalised advice.

Case studies, comparisons, statistics, research and recommendations are provided “AS IS” and intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice. Visa Inc. neither makes any warranty or representation as to the completeness or accuracy of the information within this document, nor assumes any liability or responsibility that may result from reliance on such information. The information contained herein is not intended as investment or legal advice, and readers are encouraged to seek the advice of a competent professional where such advice is required. When implementing any new strategy or practice, you should consult with your legal counsel to determine what laws and regulations may apply to your specific circumstances. The actual costs, savings and benefits of any recommendations, programs or “best practices” may vary based upon your specific business needs and program requirements. By their nature, recommendations are not guarantees of future performance or results and are subject to risks, uncertainties and assumptions that are difficult to predict or quantify. All brand names, logos and/or trademarks are the property of their respective owners, are used for identification purposes only, and do not necessarily imply product endorsement or affiliation with Visa.

This presentation contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 that relate to, among other things, [our future operations, prospects, developments, strategies, business growth and financial outlook]. Forward-looking statements generally are identified by words such as “believes,” “estimates,” “expects,” “intends,” “may,” “projects,” “could,” “should,” “will,” “continue” and other similar expressions. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the SEC. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.