-

Recurring payments, REIMAGINED

Visa A2A

Visa A2A brings standardisation, protection, and a seamless user experience to account-to-account payments – all powered by Visa’s trusted infrastructure.

Recurring payments haven’t kept up

Today’s consumers expect speed, visibility and control, across every payment. While Direct Debit remains a trusted option, it wasn’t built for the digital-first world.

It’s time for an upgrade.

Introducing Visa A2A: designed for today, built to scale

Visa A2A is a new standard for recurring account-to-account payments, it’s designed for the needs of today’s consumer, with the protections they know and trust.

It connects banks, payment initiators and businesses through a single, open system – offering real-time visibility, fewer failures and experiences consumers trust.

Smart infrastructure. Real value.

Engineered for every step

Powering some of today’s most valuable flows

Bill payments and financial services

Utilities, telecoms, investments, insurance

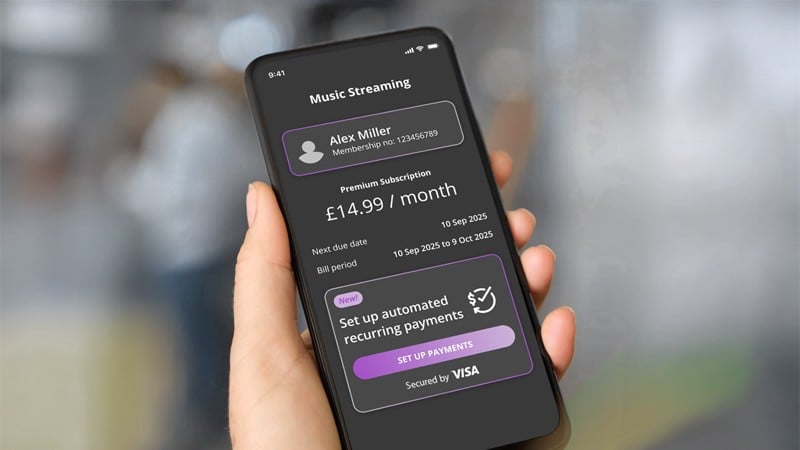

Subscriptions

Streaming, charities, nursing, auto associations

E-commerce and one-click payments

Repeat online purchases, similar to the card-on-file experience

Built for every participant

A faster, more flexible way to get paid

Reduce failures, streamline reconciliation, and offer a seamless and trusted experience that helps improve conversions.

Innovation through collaboration

Visa A2A’s first transaction marks a milestone in recurring payments. Hear how Kroo, Utilita and Tink helped bring it to life.

From insights to action

Visa’s latest research reveals what consumers and merchants really want: more control, better visibility, and fast payments that just work. From trust and protection to speed and flexibility, Visa A2A is designed around what matters most. Explore the findings:

Unlock the full potential of recurring A2A

A strategic deep dive into the structural challenges and commercial barriers limiting A2A adoption – plus a roadmap for building scalable, secure, and trusted recurring payment flows.

What do consumers really want from recurring payments?

This whitepaper reveals why speed, trust, control, and flexibility are non-negotiable – and where today’s systems fall short of delivering.

FAQs

-

-

Existing A2A payments and the open banking landscape at large aren’t providing players with effective dispute management or a sustainable, risk-based commercial model. There also isn’t a singular standard for API and UX, resulting in inconsistent experiences for payers and payees.

Visa A2A integrates Visa's robust capabilities with local payment rails, establishing a trusted network for account-to-account payments. It helps boost consumer protection and control with smarter bank transfers by creating a network of trusted Payer Financial Institutions and Payment Initiators with the ability to initiate A2A payments in a safe and secure way.

-

-

Visa A2A was created in response to the growing global trend in alternative payments—delivering a standard set of rules that governs participants and ensures a fair and consolidated experience.

It builds on the principles of open banking, Variable Recurring Payments (UK) and Dynamic Recurring Payments (EU) by enabling Payers to establish a long-standing consent, with defined parameters, that allows a Payment Initiator to initiate multiple payments over time.

-

-

Payment Initiators and Payer Financial Institutions are participants in Visa A2A and act as service providers to the Beneficiary and Payer respectively.

- Beneficiary Financial Institution: Holds the account on behalf of the beneficiary.

- Beneficiary: Is the seller of goods or services.

- Payment Initiator: Provides technical services to the beneficiary to enable initiation of payments.

- Visa A2A: Operates and manages participation, the rulebook, technical platform for connectivity, and fraud and dispute operations.

- Payer Financial Institution: Holds the account on behalf of the payer.

- Payer: Is the buyer of goods and services.

-

-

Enhanced customer experience and satisfaction: Visa A2A provides customers with increased flexibility and control over recurring payments, which can enhance loyalty and satisfaction.

Secure and reliable A2A payment method: Visa A2A helps ensure transactions are conducted securely and reliably through its robust security infrastructure, offering peace of mind to both banks and customers and bolstering trust.

Faster way to pay: Visa A2A streamlines and standardises the account-to-account payment experience, offering a flexible, secure and robust solution for modern payment needs across various use cases.

Increased choice and control: Visa A2A helps create more choice for consumers. It’s accessible across banks and payment initiators, with consumer-controlled payment conditions that are securely authenticated.

Reliable structure: Visa A2A delivers a central body of rules and standards, ensuring a consistent and reliable experience for Payers.

-

-

Clear economic model: Visa A2A offers an economic model that’s flexible enough to enable different use cases and enables investment and innovation.

Simple connectivity model: Visa A2A enables Payer Financial Institutions to seamlessly connect with Payment Initiators via a single integration with Visa A2A APIs.

Fraud monitoring and reporting: Visa A2A enables fraud monitoring and reporting to help mitigate fraudulent activity.

Robust dispute resolution: Visa A2A offers a clear and robust dispute resolution mechanism to manage disputes.

-

-

Greater customer reach: Payment Initiators will be able to access all participating Payer Financial Institutions and use cases via a unified integration, streamlining operations and increasing access to customer accounts.

Scalable Commercial Model: Under Visa A2A, Payment Initiators will be able to have a contract directly with Visa to access multiple Payer Financial Institutions across different use cases.

Simple connectivity model: Visa A2A enables Payment Initiators to seamlessly connect with all Payer Financial Institutions via a single integration with Visa A2A APIs.

Fraud monitoring and reporting: Visa A2A enables fraud monitoring and reporting to mitigate fraudulent activity.

Robust dispute resolution: Visa A2A offers a clear dispute resolution mechanism to manage disputes.

-

-

Dispute Resolution Assurance: Visa A2A offers robust dispute resolution management.

Enhanced protections and fraud monitoring: Visa A2A offers a clear liability framework and card-like protections that help protect your business.

Faster, more convenient payments: Visa A2A enables instant or near-instant payments and a seamless way to create mandates for recurring payments, resulting in fewer failed transactions and making it easier for beneficiaries to manage cash flow and reconcile.

Sustainable: Visa A2A is designed to evolve alongside advancements in the payment industry, ensuring Beneficiaries stay relevant and offer consumers the most up-to-date payment options.

Trusted by customers: Customers can use a secure payment method from a brand that they know and trust.

Offer customers flexibility: Give customers flexibility and control over their payments.

1. Visa / Basis Research. The Consumer Opportunity for Visa A2A Payments. 2024. Research was commissioned by Visa and conducted by Basis Research in 2024 via 20 online in-depth interviews (60 minutes each) with UK consumers, and an online survey of 4,400 respondents.

.jpg)